Navigating the cost of higher education can be daunting, but financial aid packages play a crucial role in making college more affordable for many students and their families. Understanding how these packages work and their impact on college affordability is essential for making informed decisions about financing your education. Here’s a comprehensive look at how financial aid packages affect college affordability and how you can maximize their benefits.

Understanding Financial Aid Packages

A financial aid package is a combination of various forms of financial assistance offered to students to help cover the cost of college. These packages typically include a mix of grants, scholarships, loans, and work-study opportunities. The goal of a financial aid package is to reduce the out-of-pocket expenses for students and make higher education more accessible.

**1. *Grants and Scholarships*

Grants and scholarships are considered “gift aid” because they do not need to be repaid. They can significantly reduce the overall cost of college.

- Grants: Often need-based, grants are awarded based on financial circumstances. Examples include the Federal Pell Grant and state-specific grants. These grants are typically offered to students with demonstrated financial need, as determined by the Free Application for Federal Student Aid (FAFSA).

- Scholarships: These are awarded based on various criteria, such as academic achievement, athletic ability, or special interests. Scholarships can come from the college itself, private organizations, or community foundations. Unlike loans, scholarships do not require repayment and can substantially decrease the total cost of education.

**2. *Loans*

Student loans are borrowed funds that must be repaid with interest. Financial aid packages often include both federal and private loans:

- Federal Loans: These loans typically offer lower interest rates and more favorable repayment terms compared to private loans. Federal student loans include Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans for parents and graduate students. Federal loans may also come with benefits such as income-driven repayment plans and potential loan forgiveness options.

- Private Loans: Offered by banks and private lenders, these loans usually have higher interest rates and less flexible repayment terms. Private loans should generally be considered only after exhausting federal loan options.

**3. *Work-Study Opportunities*

Work-study programs provide students with part-time jobs to help cover educational expenses. The earnings from a work-study position can be used to pay for tuition, books, and living expenses. Work-study jobs are often on-campus, allowing students to balance work with their academic responsibilities.

Impact on College Affordability

**1. *Reducing Out-of-Pocket Costs*

Financial aid packages can significantly reduce out-of-pocket costs for families. By combining grants, scholarships, and work-study, students can lower their total tuition bill and minimize the amount needed in loans. This reduction in out-of-pocket expenses makes college more affordable and can alleviate some of the financial strain on students and their families.

**2. *Minimizing Loan Debt*

Effective use of financial aid packages can minimize the amount of student loan debt incurred. By maximizing grants and scholarships, students can reduce their reliance on loans. Additionally, understanding and utilizing federal loan benefits, such as income-driven repayment plans, can further ease the burden of student debt.

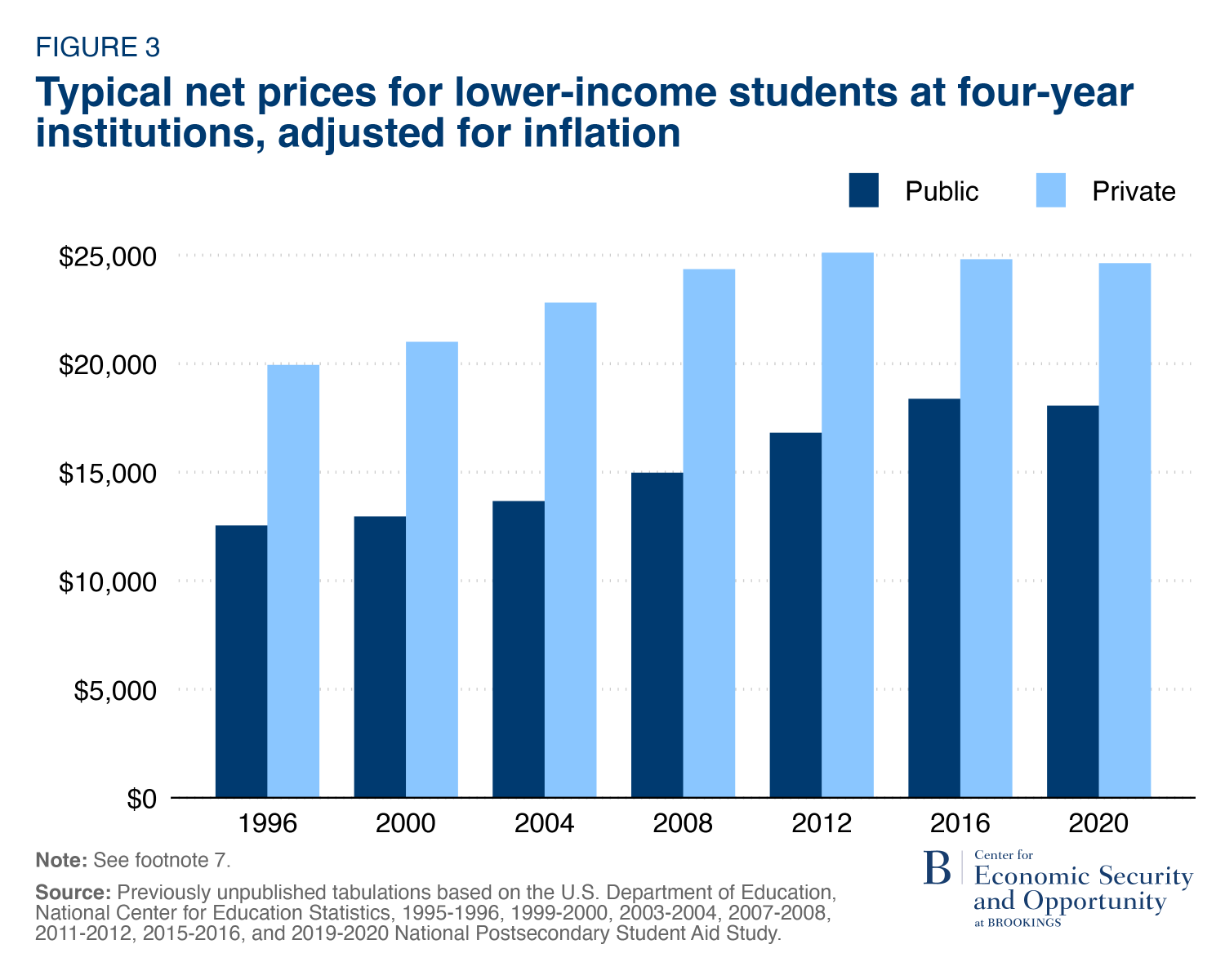

**3. *Making College Accessible*

Financial aid packages play a critical role in making college accessible to a broader range of students. By covering part of the cost of attendance, these packages help bridge the gap between what families can afford and the actual cost of education. This support is essential for students from low- and moderate-income backgrounds, allowing them to pursue higher education without excessive financial hardship.

Maximizing Your Financial Aid Package

**1. *Complete the FAFSA Early*

Submitting the FAFSA early is crucial for accessing federal and state financial aid. Many financial aid programs have deadlines, and applying early ensures that you are considered for the maximum amount of aid available.

**2. *Research and Apply for Scholarships*

Actively search for and apply to scholarships from various sources. Many scholarships have specific criteria, so tailor your applications to match the eligibility requirements. Utilizing scholarship search engines and consulting with high school counselors can help you find additional funding opportunities.

**3. *Understand Loan Terms*

If loans are part of your financial aid package, carefully review the terms and conditions. Understand the interest rates, repayment schedules, and any potential benefits associated with federal loans. Be cautious with private loans, and compare offers to ensure you are getting the best possible terms.

Conclusion

Financial aid packages play a vital role in making college more affordable and accessible. By understanding the components of financial aid—grants, scholarships, loans, and work-study opportunities—you can effectively manage your educational expenses and minimize the financial burden of higher education. Plan ahead, apply early, and utilize available resources to maximize your financial aid package and make your college experience financially manageable.